Ordinance no. 126/2019, of May 2, which defines the structure of the file for the communication of Valued Inventories to TA, replaces the previous Ordinance No. 2/2015, of January 6, modifying the structure and features of the respective file by passive subjects to the Tax Authority. With this update the communication of the inventories to the TA now includes the information regarding the valuation of the inventory.

In view of the previous structure, the only change is the addition of the new field "ClosingStockValue" which specifies the value of the stock, now also the object of communication to the Tax Authority and not only the quantities, as previously required.

This ordinance shall enter into force on January 1, 2020 and shall apply to the communications of inventories relating to the tax periods of 2019 and following.

Before January 31, by means of electronic transmission of data, the valuated inventory related to the last day of the previous fiscal year, shall be communicated to the AT by natural or legal persons that have a registered office, permanent establishment or fiscal domicile in the national territory, have organized accounts and are obliged to draw up an inventory, through a file whose characteristics and structure are defined by an ordinance of the Ministry of Finance.

Are dispensed the persons whom the simplified tax regime for IRS or IRC applies, irrespective of turnover.

For persons taking a tax period different from the calendar year, the notification shall be made by the end of the first month following the date of expiry of that period.

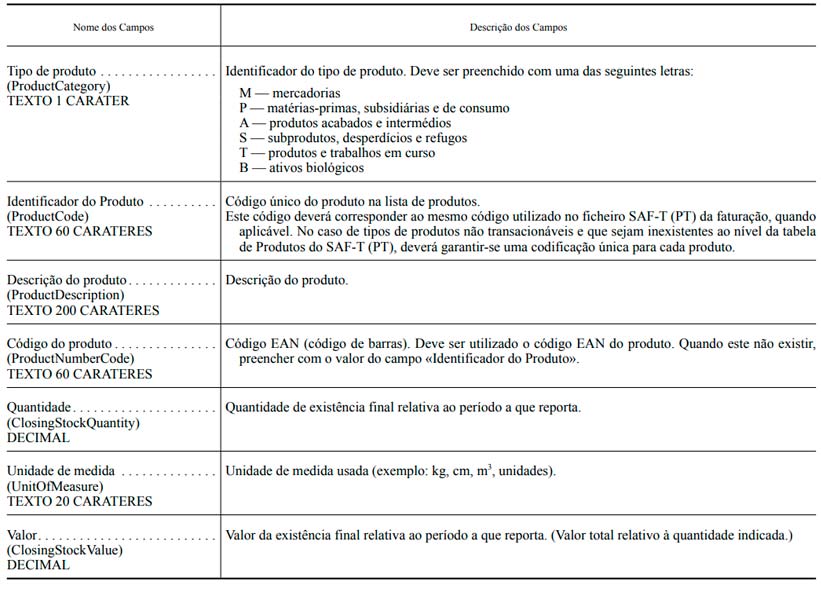

The file must contain an inventory table, with identification and total valuation of each product, obeying the following information structure:

The XML format file must comply with the validation scheme of the file in xsd format, available in the Finance Portal.

The new rules on invoicing reinforce the control of transactions carried out by taxable persons with a view to fight the informal economy, fraud and tax evasion.